2024 1040 Schedule 433b – Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 1040 Schedule 433b

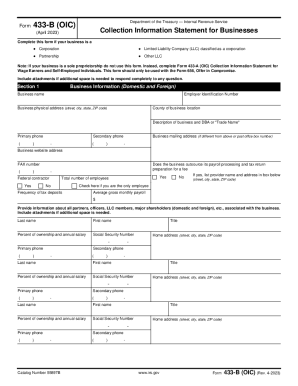

Source : taxcure.com2023 Form IRS 433 B (OIC) Fill Online, Printable, Fillable, Blank

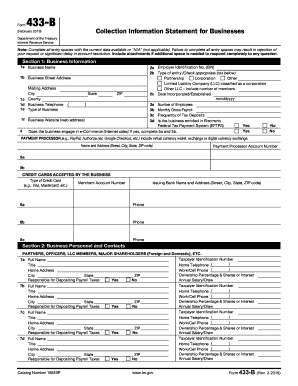

Source : irs-form-433-b.pdffiller.comKLH Management Company

Source : www.facebook.com2023 Form IRS 433 B (OIC) Fill Online, Printable, Fillable, Blank

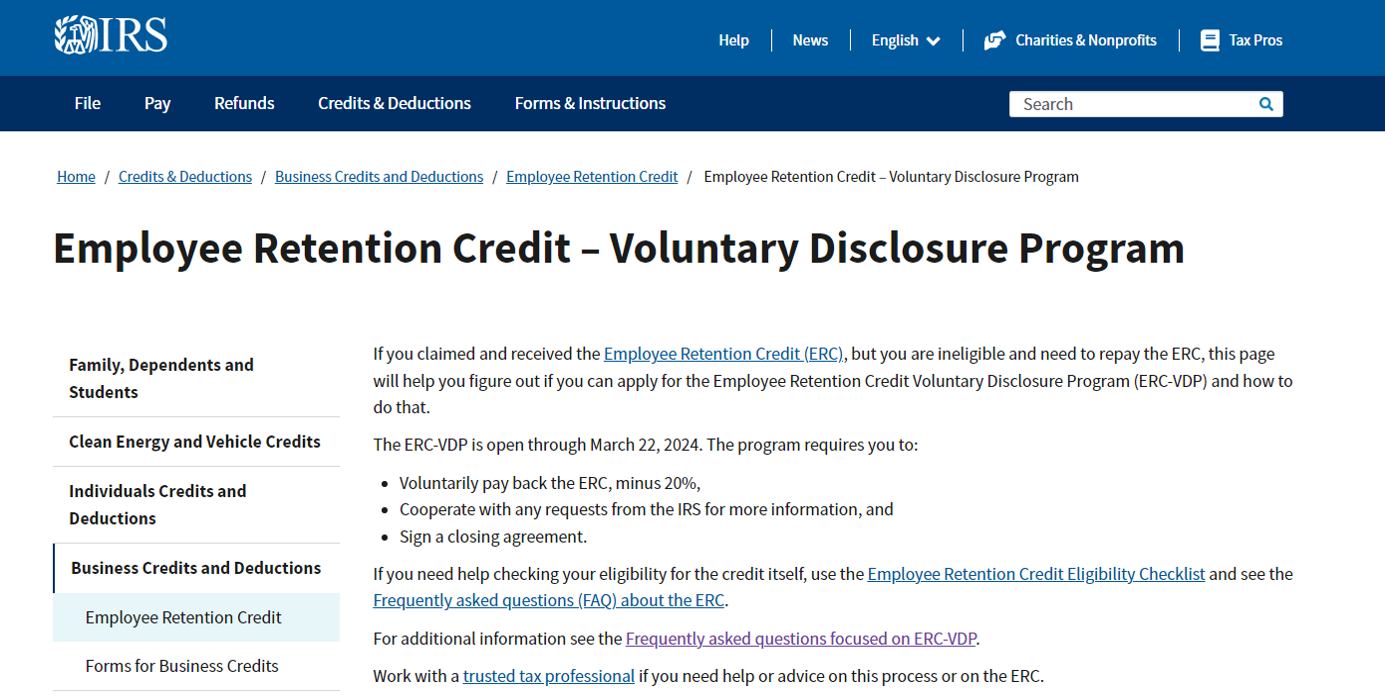

Source : irs-form-433-b.pdffiller.comIRS Implements Program to Repay Ineligible ERC Claims GYF

Source : gyf.comIRS 433 B 2019 2024 Fill and Sign Printable Template Online

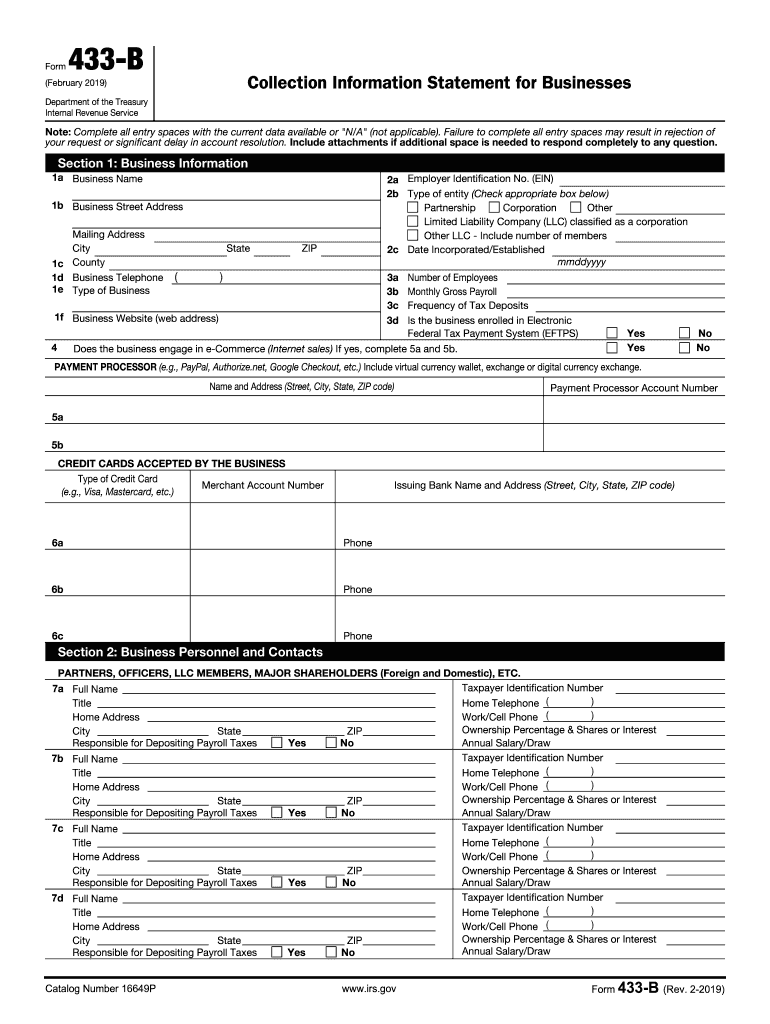

Source : www.uslegalforms.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govForm 433 b: Fill out & sign online | DocHub

Source : www.dochub.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govOic 433 b: Fill out & sign online | DocHub

Source : www.dochub.com2024 1040 Schedule 433b IRS Form 433 B: Instructions & Purpose of this Statement: To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . You must file Form 1040 and Schedule A to itemize. Some itemized deductions are limited based on a taxpayer’s AGI. Others are restricted to a threshold, or percentage, of the filer’s AGI. .

]]>